Wealth Strategies & Strong Credit to Secure Your Future

Protect, Build, and Grow: Your Path to Financial Freedom

Unlock Your Financial Power with Strong Credit

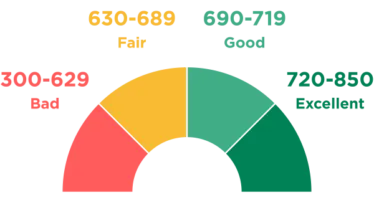

Your credit score is more than just a number—it’s the foundation of your financial future. It determines your ability to secure loans, buy a home, start a business, and even access everyday essentials like a car or rental property.

Whether you’re looking to build wealth, gain financial stability, or take your business to the next level, your credit score plays a crucial role in the opportunities available to you.

Why Good Credit Matters for Your Personal & Business Life

Personal Benefits of Good Credit

-

Lower Interest Rates & Better Loan Approvals – A strong credit score allows you to qualify for lower interest rates on mortgages, auto loans, and credit cards, saving you thousands of dollars over time.

-

Easier Access to Housing & Utilities – Many landlords and utility companies check your credit before approving leases or setting deposit amounts. With good credit, you can avoid high security deposits and increase your chances of getting approved.

-

More Financial Security & Flexibility – Having good credit means being able to access funds when you need them, whether for emergencies, home repairs, or investment opportunities.

Business Benefits of Good Credit

-

Increased Business Funding & Credit Lines – Whether you need startup capital or funds to expand, lenders and investors look at your credit score when deciding whether to approve your business loan or credit application.

-

Better Supplier & Vendor Terms – Many suppliers and vendors offer better payment terms and discounts to businesses with strong credit, allowing you to manage cash flow more effectively.

-

More Opportunities for Growth – With access to funding, you can invest in marketing, hire employees, purchase equipment, or expand operations—giving your business the edge it needs to thrive.

Poor Credit Can Cost You Thousands

Having a low credit score can make life unnecessarily expensive. Higher interest rates, larger down payments, limited financing options, and missed opportunities can add up quickly. The good news? Your credit can be improved with the right strategy, and I’m here to help you every step of the way.

Take the First Step to Better Credit – It’s Free!

1️⃣ Sign up for your free account & 7-day trial to access your credit reports from all three major bureaus.

Get Your Credit Reports Now

2️⃣ Schedule your personalized credit consultation to develop a strategy for improving and leveraging your credit using your three reports in step 1.

Don’t let bad credit hold you back. Take control today and unlock the financial opportunities you deserve!